Montana's 2026 Property Tax Shift: What It Means For Gallatin Valley (And Why Some Folks are Side-Eyeing It)

Montana's property tax laws are getting a major makeover starting January 1, 2026.

If you're a homeowner in the Gallatin Valley, whether that's Bozeman, Belgrade, Four Corners, or beyond, this matters to you. And while some of the changes feel like a win for full-time residents, there's a little more nuance beneath the surface.

Let's unpack it.

Why the Change?

Over the last few years, Montana's home values have skyrocketed, especially here in Gallatin Valley. But while home prices went up, our old property tax system didn't adjust. It was a flat rate: 1.35% across the board, whether you were living in your home full-time or renting it out as an Airbnb from out of state.

Lawmakers stepped in with a new system that takes effect in 2026. The goal? Give full-time Montanans a break and shift more of the tax burden to second homes and short-term rentals.

the big idea (in plain Terms)

If you live in your home 7+ months a year: You'll qualify for a homestead exemption, and your taxes will (theoretically) go down.

If it's a second home or short-term rental: Your taxes are going up. Possibly by quite a lot.

What the New Rates Look Like

For primary residences and qualifying long-term rentals (28+ day leases for at least 7 months of the year)

.png)

For second homes or short-term rentals (of any value): Flat 1.90% in 2026

Real life numbers (because math is better with Context)

Four Corners primary home ($500K):

2025: $6,750

2026: $4,580 → You save $2,170/year

Bozeman Airbnb ($900k)

2025: $12,150

2026: $17,100 → You pay $4,950 more/year

What about Agricultural properties?

If your home is on qualifying agricultural land - think a ranch in Gallatin Gateway or a legacy property in Bridger Canyon - you're exempt from the 1.90% rate hike, even if it is a second home. Your property will stay taxed at the current 1.35% rate. It's a big win for generational landowners, but it's also where some of the pushback begins.

The Good news (Especially for Locals)

- Primary residents save money - on properties valued under $1.44M

- Housing affordability may improve - slightly, but meaningfully

- Out-of-state investors help offset public costs

- It's a progressive system - higher value homes pay more

For many long-time residents, this may be one of the few moments where rising home values don't mean higher taxes.

The not-so-great (Because nothing is ever that simple)

Here's where we step off the press release and look a little closer:

Short-Term Rental Owners Feel the Squeeze

If you rely on Airbnb income to keep your second home afloat, this is going to hurt. Some may be forces to sell or raise nightly rates.

Bozeman Already Restricts Short-Term Rentals

As of December 2023, Bozeman officially banned new non-owner-occupies short term rentals (type 3). Only existing units with valid permits can continue under a grandfather clause. Even owner-occupies rentals (type 2) now require you to live on-site for at least 70% of the year, up from the previous 50%. So if you were hoping to cash-flow a part-time home in town via Airbnb, it just got a lot harder.

That means this tax hike hits hardest in areas just outside Bozeman—like Big Sky, Belgrade, Gallatin Gateway, and unincorporated county zones, where STRs are still allowed and growing in number.

Long-Term Rentals May Still Be Taxed Like Second Homes

If you rent a property full-time, but don't live in it yourself, it'll still be taxed at 1.90% unless you apply for a long-term rental exemption (which isn't automatic).

Hotel Lobby influence?

There's quiet speculation this law could benefit hotel chains more than locals. By making short-term rentals pricier to operate, and layering that on top of Bozeman's existing restrictions, it might give hotels room to regain market share... and increase their nightly rates.

No Guarantee the Revenue Stays Local

This shift is meant to be revenue-neutral at the state level, but there's no clear promise that those shifted dollars will stay in Gallatin County. So your savings could mean reduced funding elsewhere.

High Value Homeowners Could Still Pay More

Even with a lower rate, your tax bill could still go up if your home's assessed value rises (which, let's be honest - probably will).

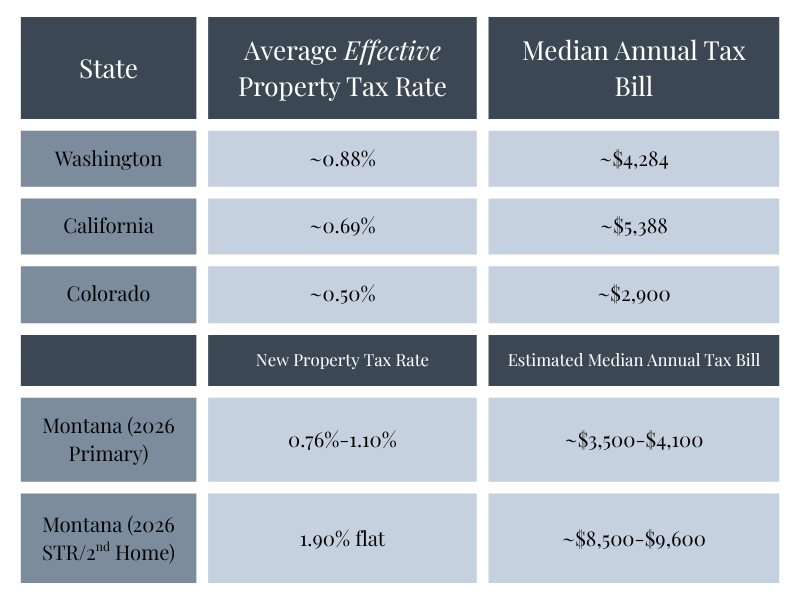

But will this deter out of state buyers? Let's look at the data

A lot of new Montana property purchasers are coming from Washington, California and Colorado. So how does Montana now compare?

Most primary homeowners in Montana will still pay less than they would in CA or WA. Colorado is the closest competitor on tax friendliness, but Montana remains attractive for full-time residents.

However, second-home buyers and short term rental investors will absolutely notice the difference. It may not stop them entirely, but it could reshape what, where and why people buy.

2025: The Transition year

Before the new law takes effect, Montana is offering a $400 rebate in 2025 for qualifying primary homeowners (due November 2025). If you receive it, you'll be automatically enrolled in the new tax tier for 2026. If you don't receive the rebate, you'll need to apply by March 1, 2026 to lock in your homestead exemption.

Key takeaway

On the surface, this law is a win for locals - and in many ways, it truly is. But it also reshuffles the deck in ways that could ripple through housing availability, short-term rental and hotel room pricing, and investor demand, especially in markets like Bozeman. This is a big, complex policy and it won't effect everyone the same.

If you have questions, or want help understanding how this impacts your home, rental or investment, fill out the contact form below. I'm happy to help you run the numbers and walk you through it, neighbor to neighbor.

Disclaimer: All information provided is deemed reliable but is presented for informational purposes only. Tax rates, values, and calculations are estimates and may vary based on individual circumstances and county assessments. For personalized advice, please consult a tax professional or local assessor’s office.

Posted by Rachel Verdone on

Leave A Comment